The Simple Side's Morning Market Espresso

Wednesday, June 25: A shot of actionable financial news that doesn't break the bank.

In case you didn’t know, my main investing newsletter is located here:

NEWSLETTER LINK.

I had someone request the daily stock updates to include fundamental and technical analysis, so this will be added at the very end of the newsletter!

Enjoy and let me know what you would like to see added or changed about the newsletter by clicking here:

Help support this newsletter by subscribing for just $1 a month. Don’t waste your time dealing with biased articles from large corporations that only care about their ad revenue.

Join The Simple Side of things.

Index Futures Snapshot

Dow Futures: 43,426.00

Fair Value: 43,402.40

Change: +2.00 (+0.00%)

Implied Open: +23.60

S&P 500 Futures: 6,156.25

Fair Value: 6,144.08

Change: +10.00 (+0.16%)

Implied Open: +12.17

NASDAQ Futures: 22,503.75

Fair Value: 22,411.11

Change: +91.00 (+0.41%)

Implied Open: +92.64

Top News & Movers

● SoftBank is spearheading a $1 trillion AI hub in Arizona in partnership with Taiwan Semiconductor Manufacturing, modeled after Shenzhen. Funding includes a $40 billion investment in OpenAI via T-Mobile US share sales.

● Tesla shares rose 1.3% premarket after unveiling a $556.8 million Megapack battery project in Shanghai—its first grid-scale energy storage deal in China.

● Meta continues its AI hiring spree, adding Daniel Gross and Nat Friedman post its $14.3 billion Scale AI acquisition. Reports suggest Meta is aggressively pursuing OpenAI talent with hefty incentives.

● Amazon announced a $233 million investment in its Indian fulfillment operations, aiming to increase processing speed and coverage.

● NTT sealed a $16.3 billion acquisition of NTT Data Group to strengthen its AI infrastructure and simplify its org structure.

● Couchbase surged 28% premarket on a $1.5 billion all-cash buyout by Haveli Investments, a 67% premium from March.

● Regeneron and Sanofi received FDA approval to expand Dupixent’s label to cover bullous pemphigoid—its 8th U.S. indication.

● Johnson & Johnson and AbbVie secured EU approval to expand Imbruvica use for mantle cell lymphoma.

● Accenture beat Q3 expectations with $3.49 EPS on $17.7 billion in revenue. New bookings surged on AI consulting demand.

● CarMax posted 9% used car unit growth and a 42.3% EPS increase, with $7.55 billion in revenue topping forecasts.

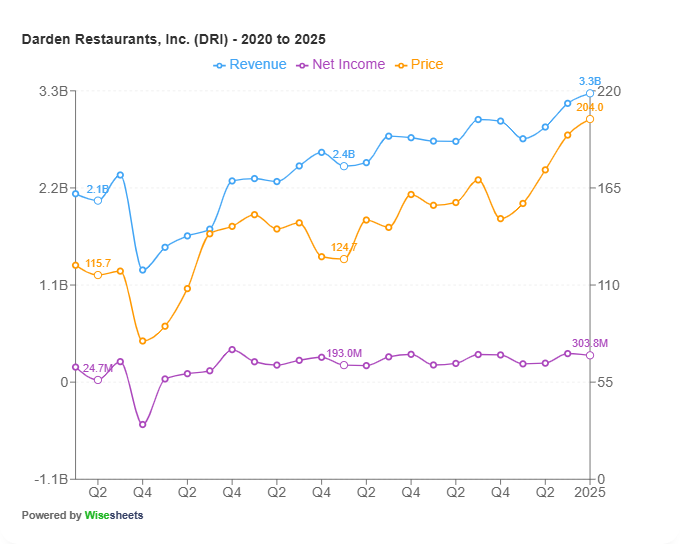

● Darden Restaurants beat Q4 estimates and raised its dividend 7.1%, also announcing it will divest Bahama Breeze.

● Cheetah Mobile reported 36.1% revenue growth YOY. It remains focused on AI/robotics and agentic AI as a long-term catalyst.

● DHT Holdings acquired a modern VLCC for $107 million to enhance fleet efficiency.

● Sarepta Therapeutics was downgraded by William Blair due to risk concerns in its Elevidys program.

● Emeren is being acquired by Shurya Vitra Ltd. for $2.00/ADS. The firm owns large solar/storage assets globally.

● Belo Sun Mining is transitioning leadership after CEO Ayesha Hira's exit.

● Artemis Gold has appointed Dale Andres (ex-Gatos Silver CEO) to lead its growth strategy.

Fundamental & Technical Watchlist

Price: $300.72 | RSI(14): 42.78 | MACD: Weak bear trend

ACN is trading below all key moving averages (20/50/200-day EMA/SMA), showing a prolonged consolidation phase. RSI levels suggest it's neither oversold nor overbought, but momentum is weak. Watch for a break above $308 for short-term confirmation. Near-term support at $292 and resistance at $310.

Price: $220.83 | RSI(14): 58.79 | MACD: Bullish crossover active

DRI is comfortably above all major averages with rising RSI. It is gaining strength post-earnings and breaking out of a 2-week base. Intraday support is at $218, with targets at $226 and stretch to $230. A MACD crossover last week points to trend continuation.

Price: $69.21 | RSI(14): 58.37 | MACD: Turning positive

KMX rebounded on strong earnings, jumping over its 20-day EMA and testing the 50-day. If it holds above $68.50, a push to $71.75 and potentially $74 is likely. RSI suggests moderate bullish momentum; confirmation would come on strong volume above $70.25.

God bless.

-¢